Insights

Content Type:

Industry:

Service:

Topic:

2023 consumer goods industry outlook

In our 2023 consumer goods industry outlook, we explore what's ahead for middle market business leaders.

Construction industry outlook

In our 2023 construction industry outlook, we explore what's ahead for middle market business leaders.

The family office journey toward operational excellence

Family office sentiments around technology, data and talent speak to a growing trend toward increasing operational efficiencies across the enterprise.

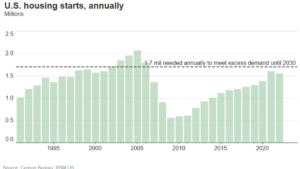

Housing starts fell last year for the first time since 2009

Housing starts dropped by 1.4% on an annualized month-ago basis, while building permits fell by 1.6%. For all of last year, housing starts fell by 3%.

A guide to business ownership

RSM’s experienced business owner tax advisors understand the business lifecycle from startup to business transition. We can point out potential blind spots, provide tips and lay out the best tax strategies to help ensure success.

Navigating workforce challenges: What drives employee satisfaction and retention?

A new RSM survey illustrates the impressions workers have of their employers and the strategies that can attract or retain them moving forward.

Year-end tax planning considerations

Tax planning considerations for businesses and individuals approaching the end of 2022.

IRS releases required minimum distribution (RMD) guidance

Notice 2022-53 announced the IRS’s intent to publish final regulations addressing required minimum distributions (RMDs) from certain plans.

The modern audit, Part 1: Technology and the audit process

How is technology changing the modern audit process? You may be surprised. Listen in to part one of our podcast series, The modern audit.

Tax planning as interest rates climb and interest expense deductions decrease

Tax planning strategies can help businesses experiencing higher interest expense due to inflation, increased interest rates and lower tax deductions.

5 ways nonprofits can stay agile

To stay nimble, nonprofit organizations should examine these five areas to enhance their ability to adapt to change.

Chart of the day: American businesses kept investing in April despite rising costs

Durable goods orders rose 0.4% on the month, following a downward revised 0.6% in March, according to data from the Commerce Department on Wednesday.